How Does a Wraparound Mortgage Work?

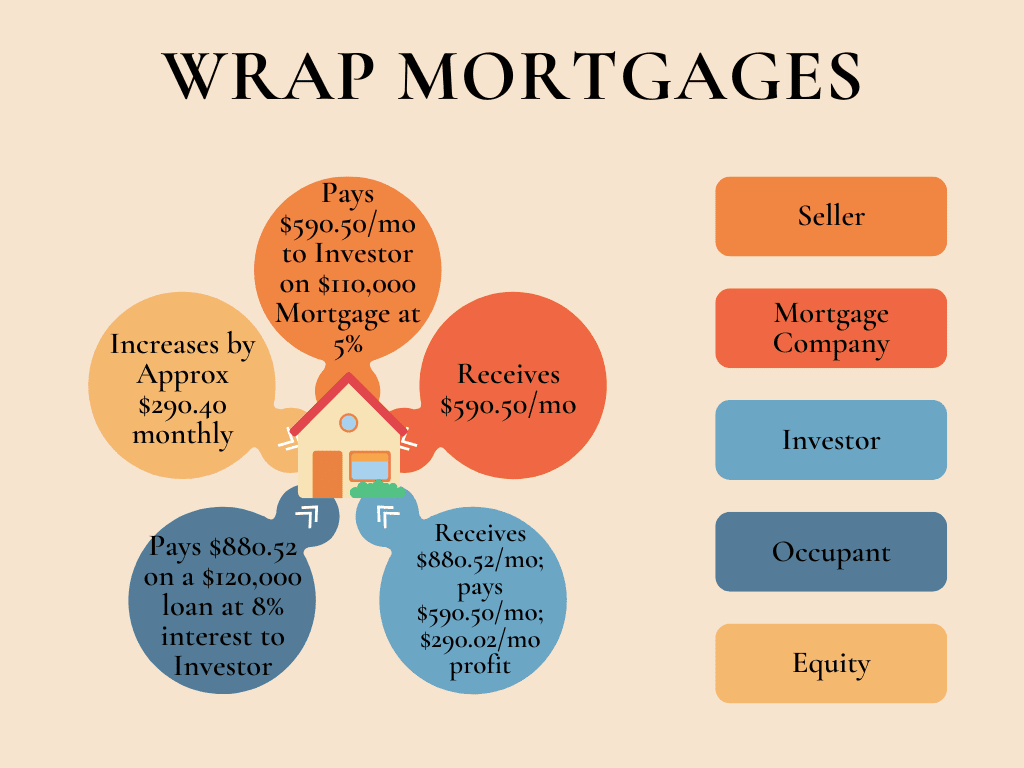

A wraparound mortgage allows a property seller to keep their original mortgage loan in place while they agree to finance the bulk of the purchase for a new buyer. The seller is effectively financing a subordinate mortgage for their buyer while keeping the original mortgage in place. It works much like a “subject to” purchase with a few key differences.

Land Contracts: What They Are And How They Work

Realty411 Featuring Gene Guarino - Build a Legacy Vol 8. No. 4

Wraparound Mortgages in Texas

Wraparound Mortgage PowerPoint Template and Google Slides Theme

Is A Wraparound Mortgage Right For You - FasterCapital

Texas All Inclusive Trust Deed - Wrap-Around Deed of Trust - Deed Of Trust Texas

What Is A Wraparound Mortgage? Definition & FAQs

Mastering Creative Finance: Subject To and Wrap Mortgages

Alabama Wrap Around Mortgage - Wrap Around Mortgage

How Does a Wraparound Mortgage Work?

Wraparound Mortgage PowerPoint and Google Slides Template - PPT Slides

Wraparound Mortgages: A Unique Approach to Financing Your Dream Home - FasterCapital

A Wrap-Around Mortgage Gone Bad… - MyTicor

Understanding Wraparound Mortgages: Managing Interest Rates with Ease - FasterCapital