1095 Forms: 1095-a vs. 1095-b vs. 1095-c

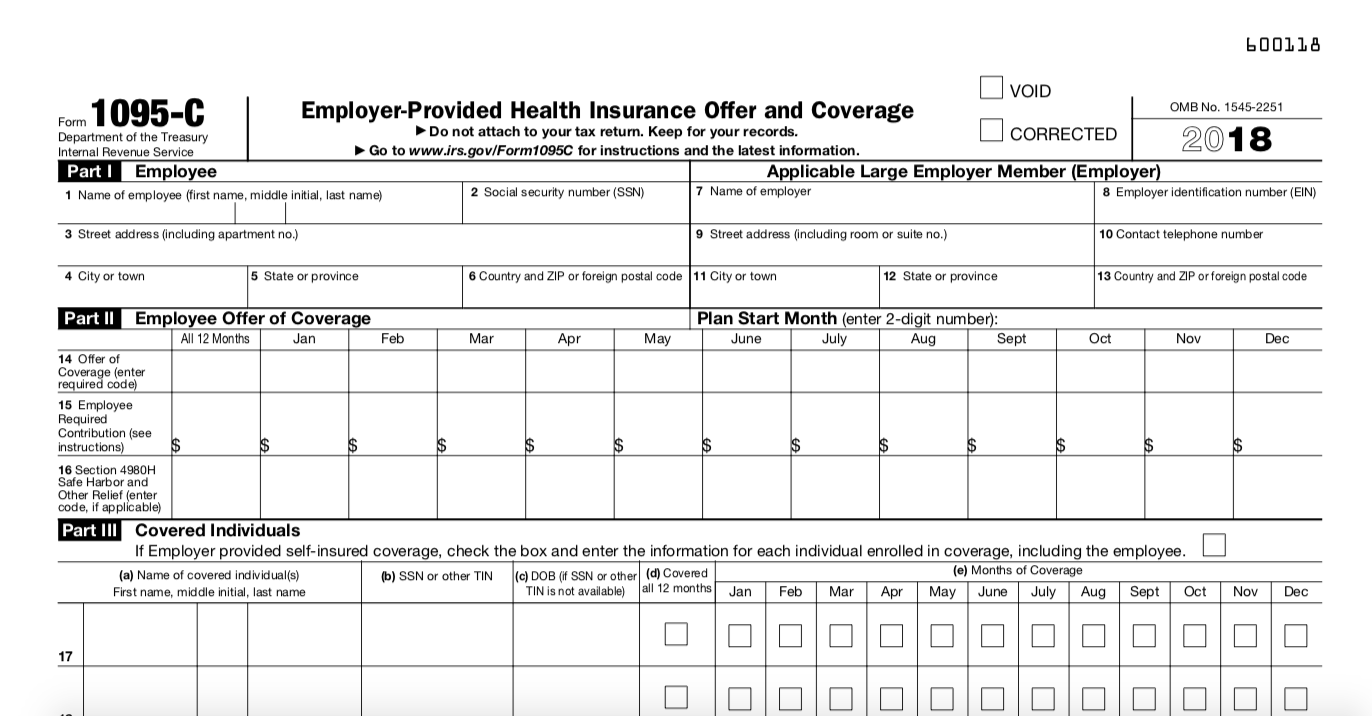

Employers may become overwhelmed by health insurance paperwork and reporting responsibilities. Under the Affordable Care Act (ACA), the IRS requires all applicable employers and qualified health plan providers to report information about their health plans and health coverage enrollment using tax Forms 1095 A, B, and C. However, there are different requirements for each of these documents.

What Are Tax Form 1095-A and 1095-B?

Short-Term vs. Long-Term Disability Insurance

View All Paychex WORX Employee Benefits Resources

What To Do With New ObamaCare Forms 1095-B, 1095-C For 2016 Tax Filing Season

-0001.png)

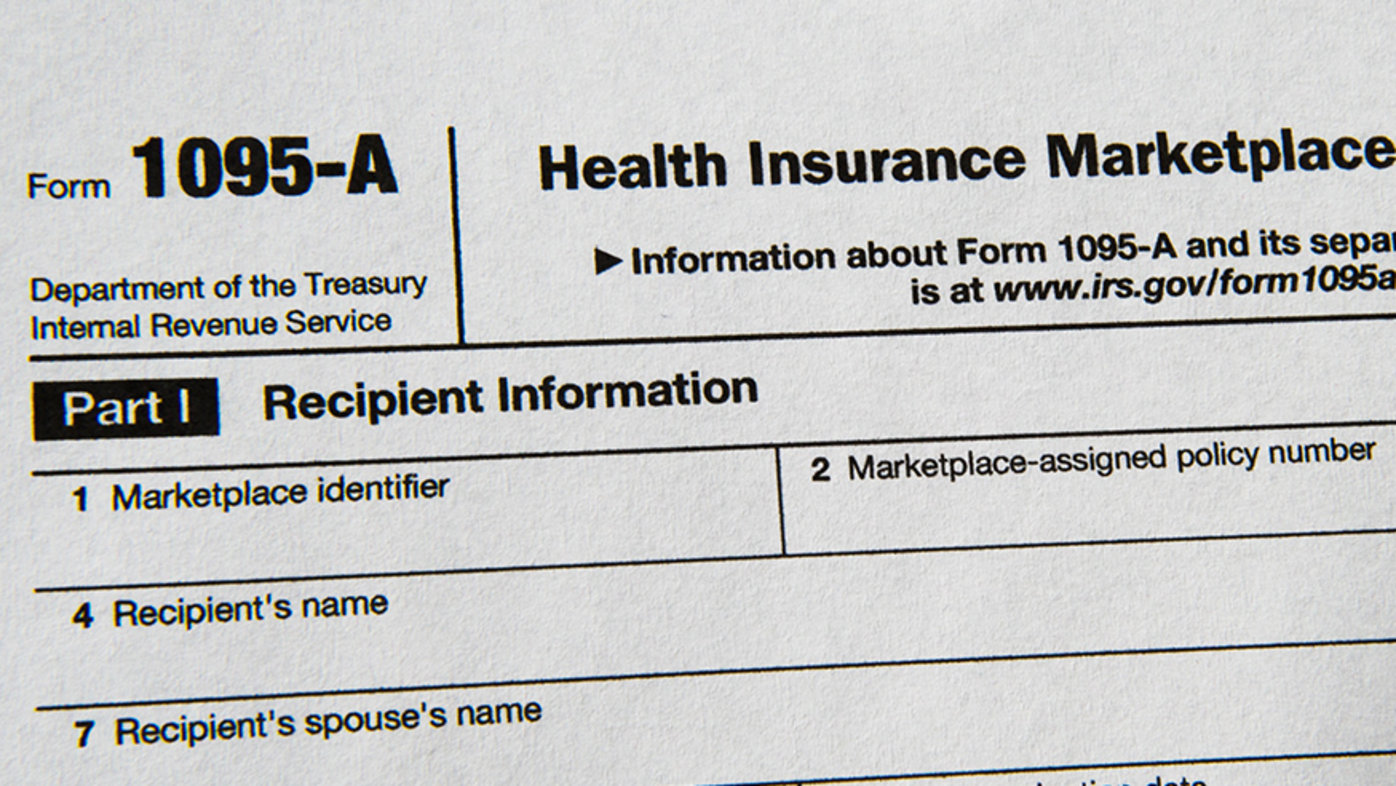

IRS Form 1095 & Form FTB 3895 and your health insurance subsidy

What is a Consumer-Driven Health Plan?

Form 1095-A, 1095-B, 1095-C, and Instructions

Understanding Tax Form 1095-C

images.ctfassets.net/pxcfulgsd9e2/articleImage1447

IRS Extends Deadline for ACA Forms to be Sent to Employees

10 Payroll Industry Trends for 2024

IRS Form 1095-a 1095-B and 1095-C Blank Lies on Empty Calendar Page Stock Image - Image of budget, currency: 161092817

Form 1095-C, Forms, Human Resources

All Large Employers MUST Complete ACA Reporting (Even Fully Insured Groups) - Workforce Consultants

What Is Form 1120-S vs. Form 1120?