1099-G tax form: Why it's important

If you received unemployment compensation during the year, you should receive the 1099-G tax form. If you got the form and didn't receive jobless benefits, you could be the victim of identity theft.

Arizonans learning of unemployment fraud in their names after receiving tax forms

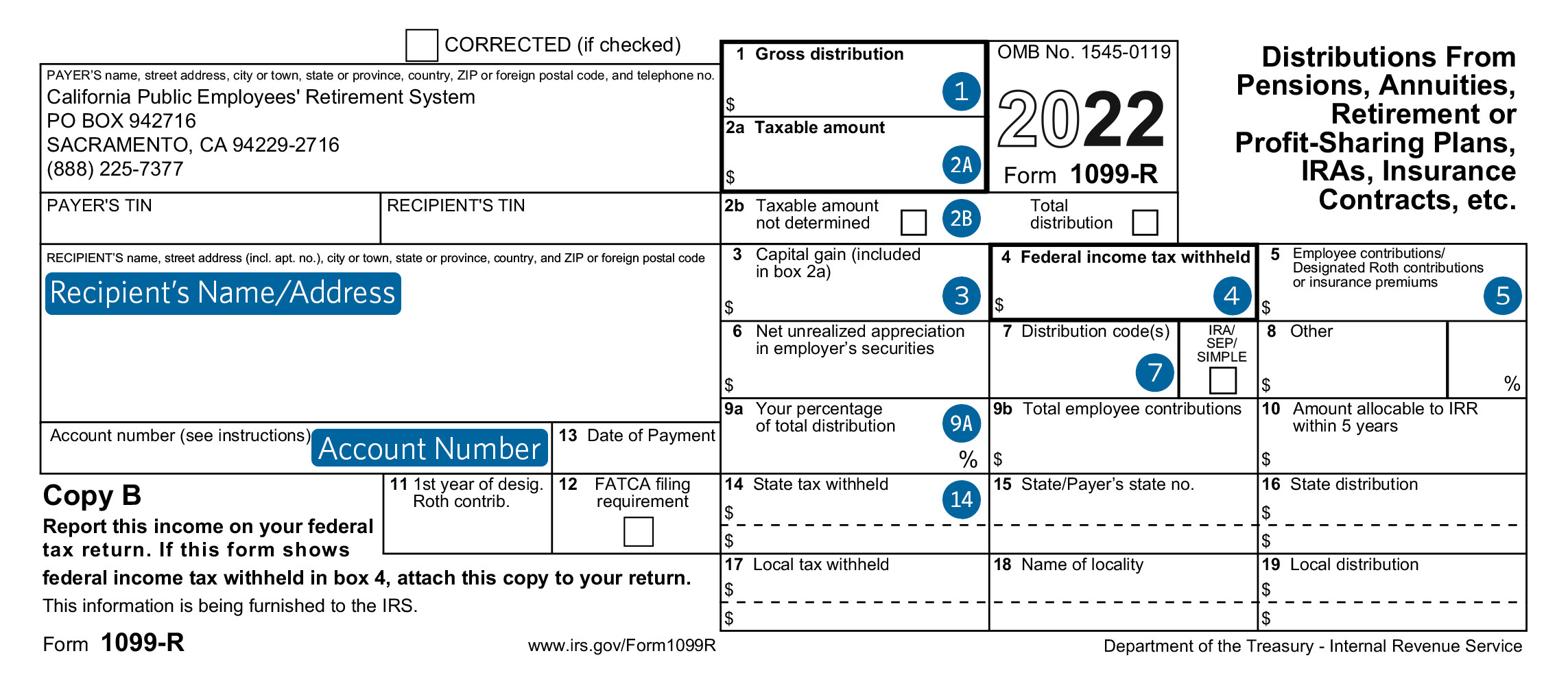

Understanding Your 1099-R Tax Form - CalPERS

1099G Tax Form Explained

What is a 1099? Types, details, and how to use it

1099-G tax form: Why it's important

Illinois 1099 G Form

When are you a simple tax return and when you are more complex form 10

Kentucky tax filing: Confused about your 1099 unemployment form?

AG Nessel, UIA Alert Residents Of Tax Form For Victims Of, 49% OFF

1099-G Tax Form

:max_bytes(150000):strip_icc()/Screenshot2023-03-03at12.03.07PM-ff198b5b354843a798ccded84acf486b.png)

What Is Form 1099-G: Certain Government Payments?

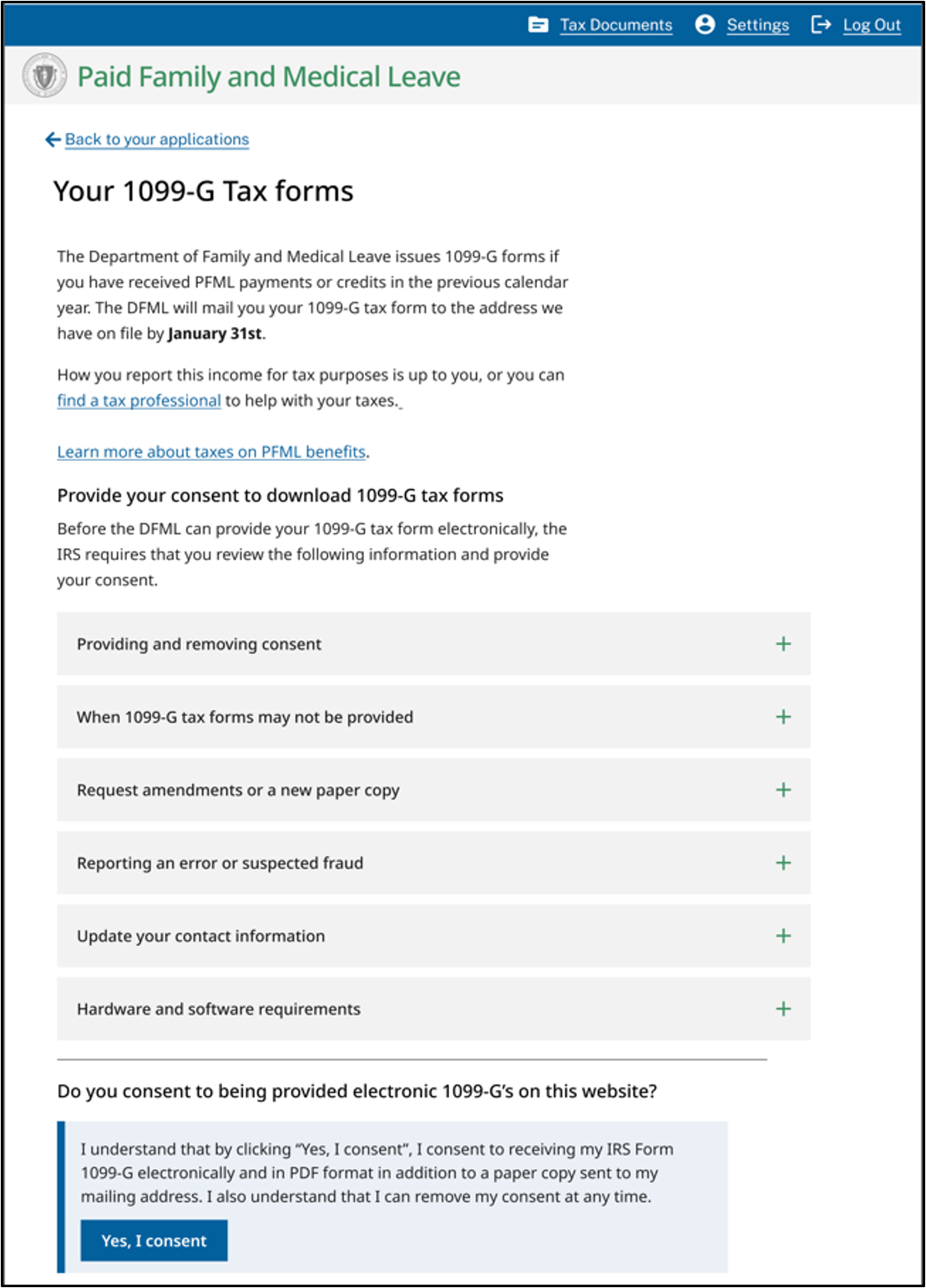

Downloading your PFML 1099-G tax form

1099-G Tax Information

LEO - Your 1099-G Tax Form

What Is a 1099-G Form?