Lines 33 - 36 Center for Agricultural Law and Taxation

Farmers total all expenses reported on Part II of the Schedule F and report the total on Line 33, Schedule F. Example 1. Georgia has $652,435 of total allowable farm expenses this year. She reports this total on Line 33, Schedule F. Net farm profit or loss is reported on Line 34, Schedule F. This is calculated by subtracting Total Expenses (Line 33, Schedule F) from Gross

Lines 33 - 36 Center for Agricultural Law and Taxation

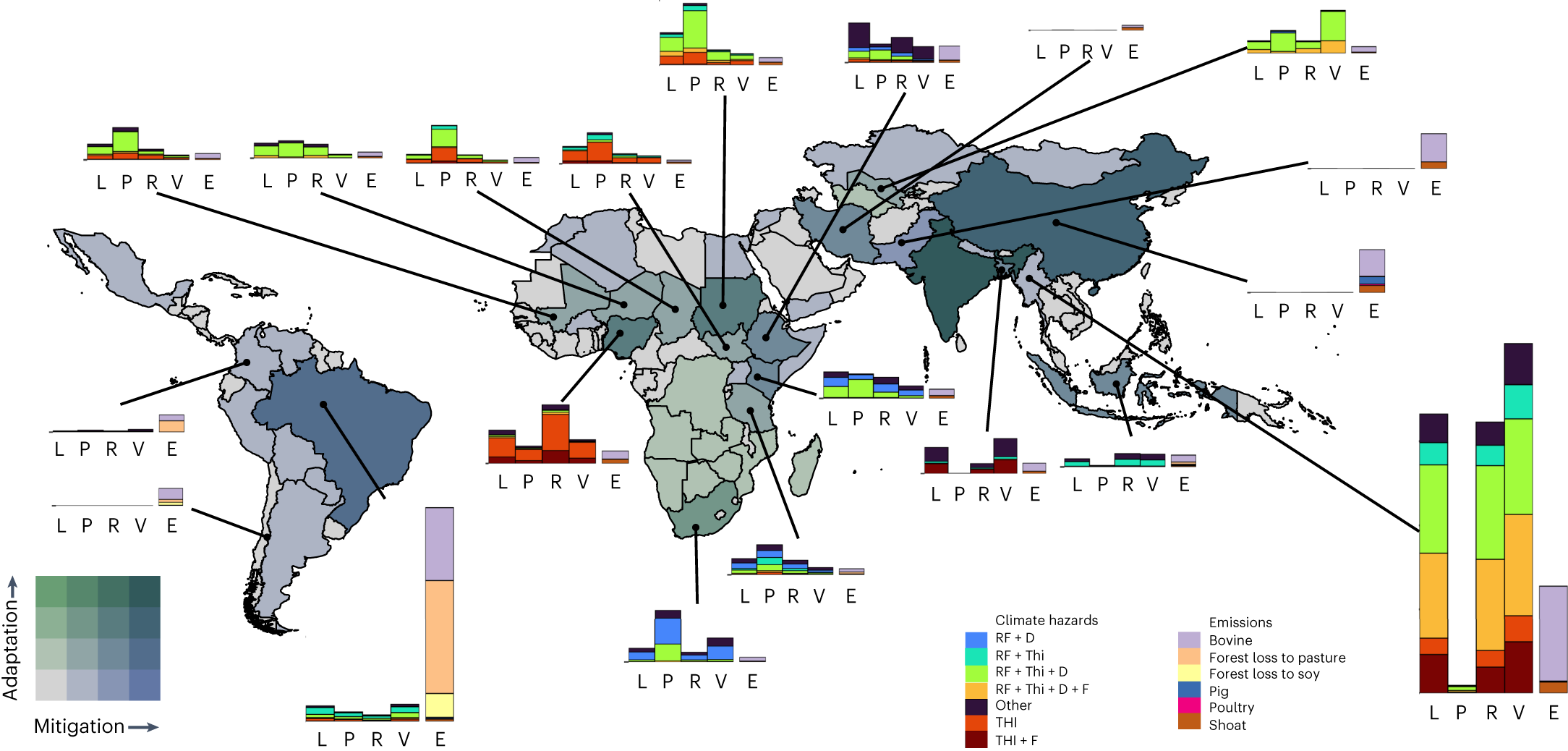

Priority areas for investment in more sustainable and climate-resilient livestock systems

Agriculture in Russia - Wikipedia

Impact of Technological Trends Scenario Planning the Next Technological Paradigm

Quitting Fossil Fuels and Reviving Rural America - Center for American Progress

Lines 33 - 36 Center for Agricultural Law and Taxation

WEVJ, Free Full-Text

:max_bytes(150000):strip_icc()/Screenshot2023-12-14101210-777d825ead72468587c3d238dfe0fe1c.png)

Federal Income Tax

Practical Law Global Guide: Doing Business in Ireland - Arthur Cox LLP

U.S. Customs and Border Protection - Wikipedia

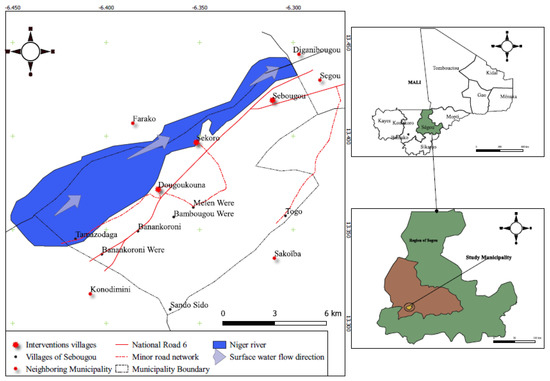

Sustainability, Free Full-Text

Land, Free Full-Text