Gift Vouchers and Cards are Actionable Claims, GST Applicable on the Date of Redemption u/s 12(4)(b) of CGST Act: Madras HC

A Single Bench of the Madras High Court has recently held that gift vouchers and gift cards are actionable claims and Goods and Services Tax

The GST/HST Credit is a non-taxable amount paid four times a year to individuals and families with low and modest incomes to help offset the goods and

Vouchers- Concept & GST implications thereon with Practical Case Studies

GST HST Rebate Claims - Jeremy Scott Tax Law

CA Anupam Sharma on X: *Madras High Court Clarifies GST Levy on Gift Vouchers as 'Actionable Claims' not Subject to Schedule III* The Madras High Court has offered clarity regarding the levy

Karnataka HC: Vouchers Are Neither Goods Nor Services Under GST

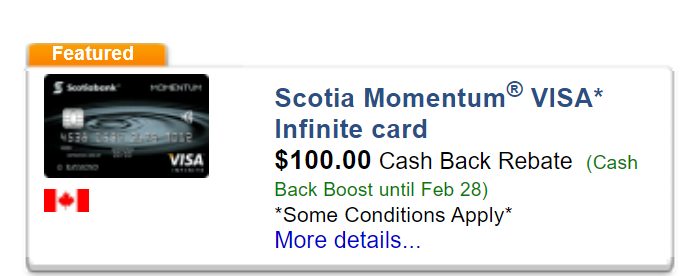

Great Canadian Rebates (GCR) Cash Back - Thread Summary for Newbie Tips - Page 2 - RedFlagDeals.com Forums

133 GST Judgments, PDF, Forgery

Madras High Court Clarifies GST Treatment for Gift Vouchers: Impact on Kalyan Jewellers Case

Taxscan on LinkedIn: Depreciation Allowable on Goodwill u/s 32(1

Taxability Of Discounts, Vouchers, Coupons & Gift Cards Under GST Regime - TaxO