Australia Corporate Bonds: BBB-rated: 10 Years: Yield, Economic Indicators

Australia Corporate Bonds: BBB-rated: 10 Years: Yield data was reported at 4.510 % in Apr 2018. This records an increase from the previous number of 4.390 % for Mar 2018. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data is updated monthly, averaging 6.810 % from Jan 2005 to Apr 2018, with 149 observations. The data reached an all-time high of 13.410 % in Dec 2008 and a record low of 4.090 % in Nov 2017. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data remains active status in CEIC and is reported by Reserve Bank of Australia. The data is categorized under Global Database’s Australia – Table AU.M008: Corporate Bond Yield and Spread.

Australia Corporate Bonds: BBB-rated: 10 Years: Yield data was reported at 4.510 % in Apr 2018. This records an increase from the previous number of 4.390 % for Mar 2018. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data is updated monthly, averaging 6.810 % from Jan 2005 to Apr 2018, with 149 observations. The data reached an all-time high of 13.410 % in Dec 2008 and a record low of 4.090 % in Nov 2017. Australia Corporate Bonds: BBB-rated: 10 Years: Yield data remains active status in CEIC and is reported by Reserve Bank of Australia. The data is categorized under Global Database’s Australia – Table AU.M008: Corporate Bond Yield and Spread.

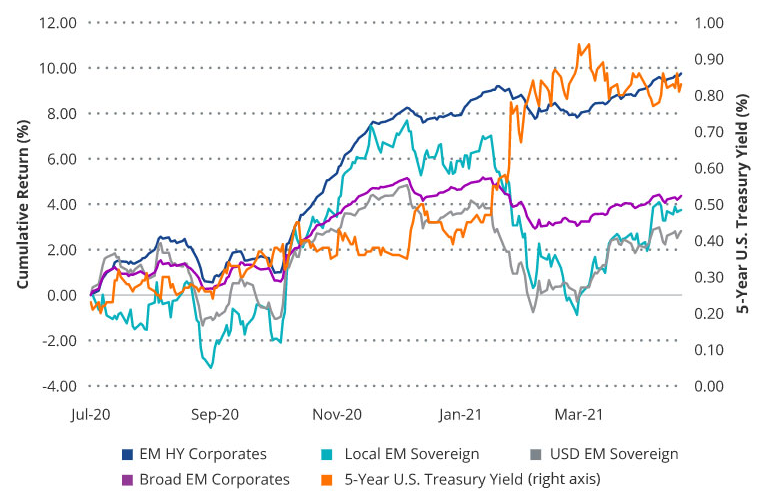

EM High Yield Bonds Withstand Rising Rates

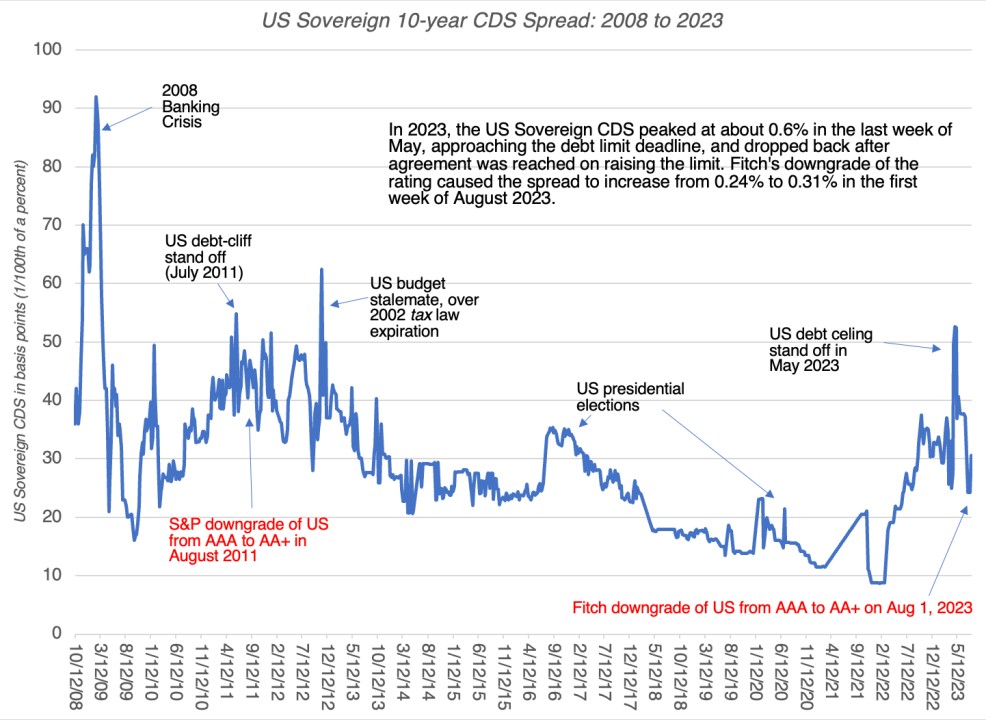

In Search of Safe Havens: The Trust Deficit and Risk-free Investments

Municipal bond outlook 2023: Three reasons for optimism

Why corporate bonds are no longer boring

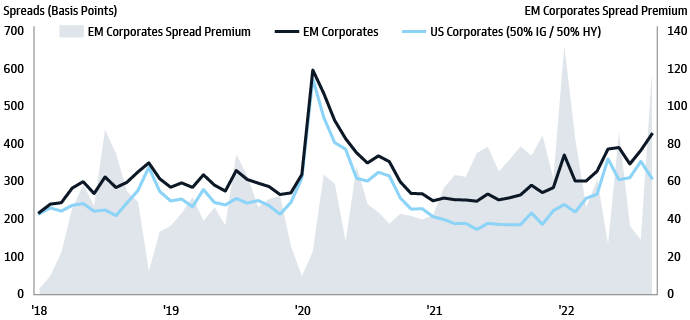

Navigating The EM Corporate Bond Market

Daily Australian Bond Yields - 30 June 2022 • YieldReport

Corporate Credit Outlook 2024: High Tide for Yield?

Municipal bond outlook 2023: Three reasons for optimism

Interest Rates: Long-Term Government Bond Yields: 10-Year: Main (Including Benchmark) for Australia (IRLTLT01AUA156N), FRED

Thinking Through Fixed-Income Allocations in an Uncertain Environment

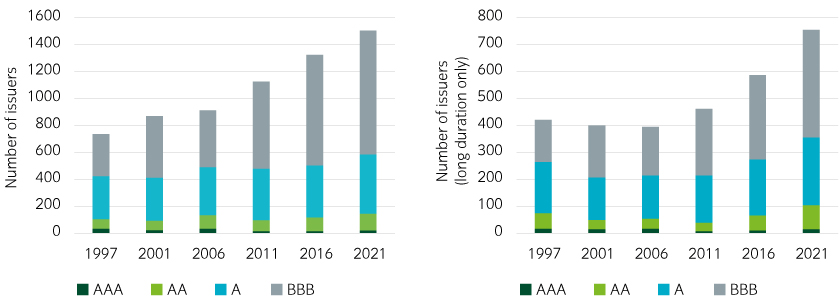

Investment Grade Corporate Bond Risk

US Investors Can Gain Hedge Edge with Global Bonds

Chart: Which Risks Have Been Rewarded? – Global X ETFs

Credit Insights: Embracing the great BBB convergence

Investment Grade Corporate Bond Risk