Low-Income Housing Tax Credit Could Do More to Expand Opportunity

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

Incentivizing Developers To Reuse Low Income Housing Tax Credits - Federation of American Scientists

Low Income Housing Tax Credit: Invest in Communities and Reduce Your Taxes - FasterCapital

Improving Low-Income Housing Tax Credit Data for Preservation – New Report by NLIHC and PAHRC!

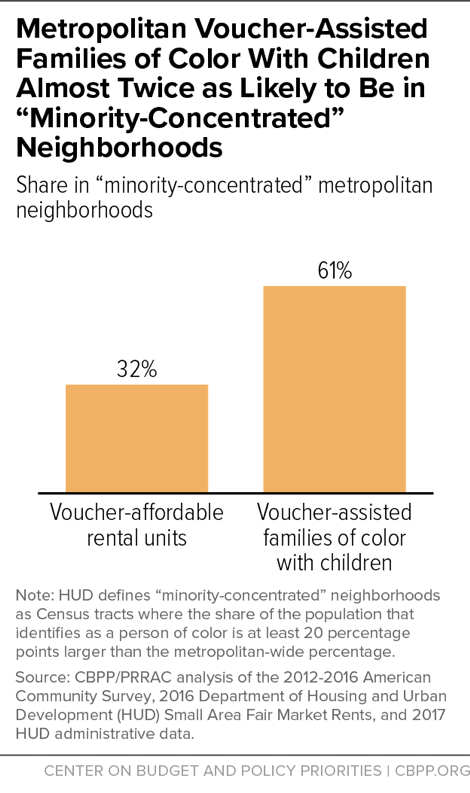

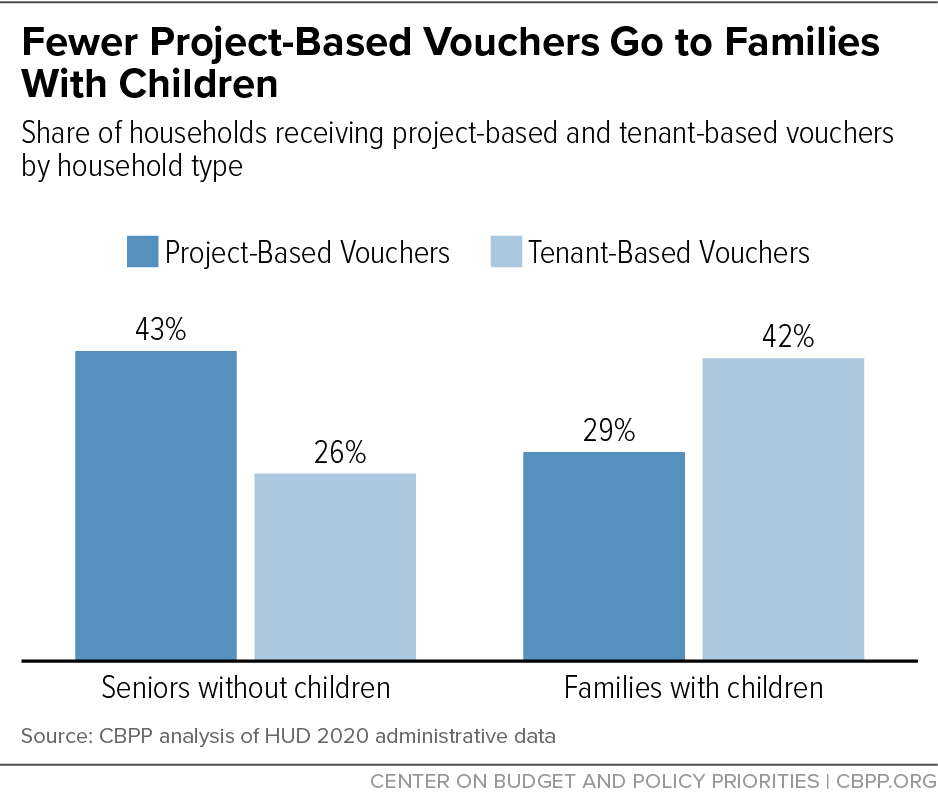

Where Families With Children Use Housing Vouchers

/cdn.vox-cdn.com/uploads/chorus_asset/file/24468051/1244775498.jpg)

It's time for Biden to prioritize the affordable housing shortage - Vox

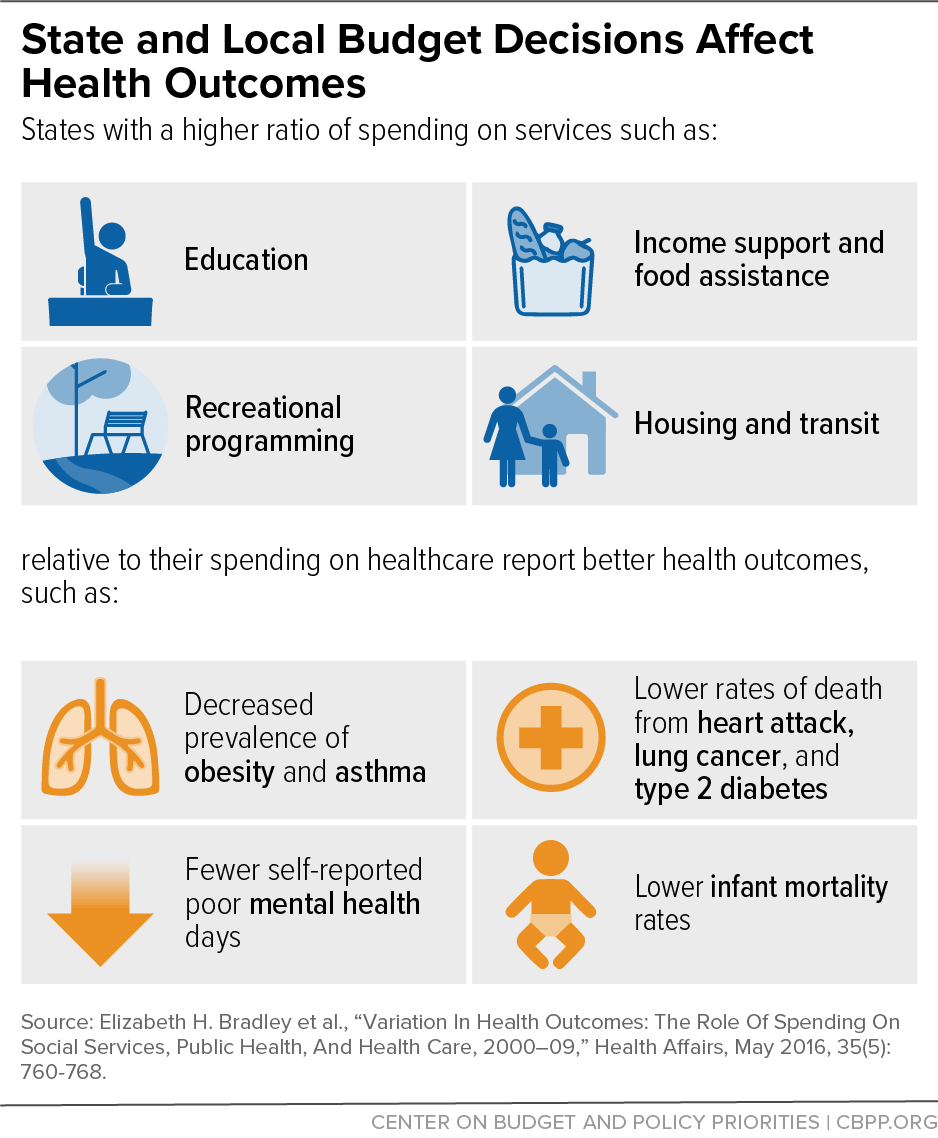

Better State Budget, Policy Decisions Can Improve Health

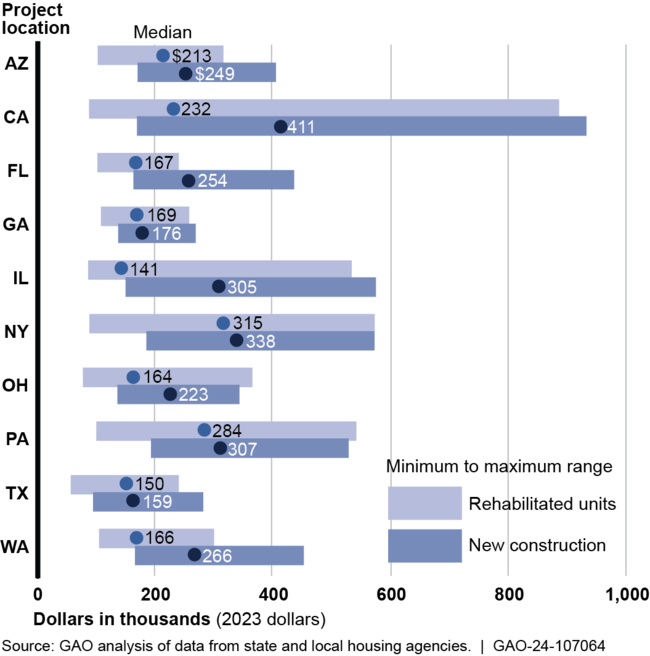

Low-Income Housing Tax Credit: Opportunities to Improve Oversight

Project-Based Vouchers: Lessons from the Past to Guide Future Policy

Congress May Expand The Low-Income Housing Tax Credit. But Why?

Low Income Housing Tax Credit Toolkit - Open Communities Alliance