Can I Claim a Boyfriend/Girlfriend as a Dependent on Income Taxes? - TurboTax Tax Tips & Videos

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets the IRS definition of a "qualifying relative."

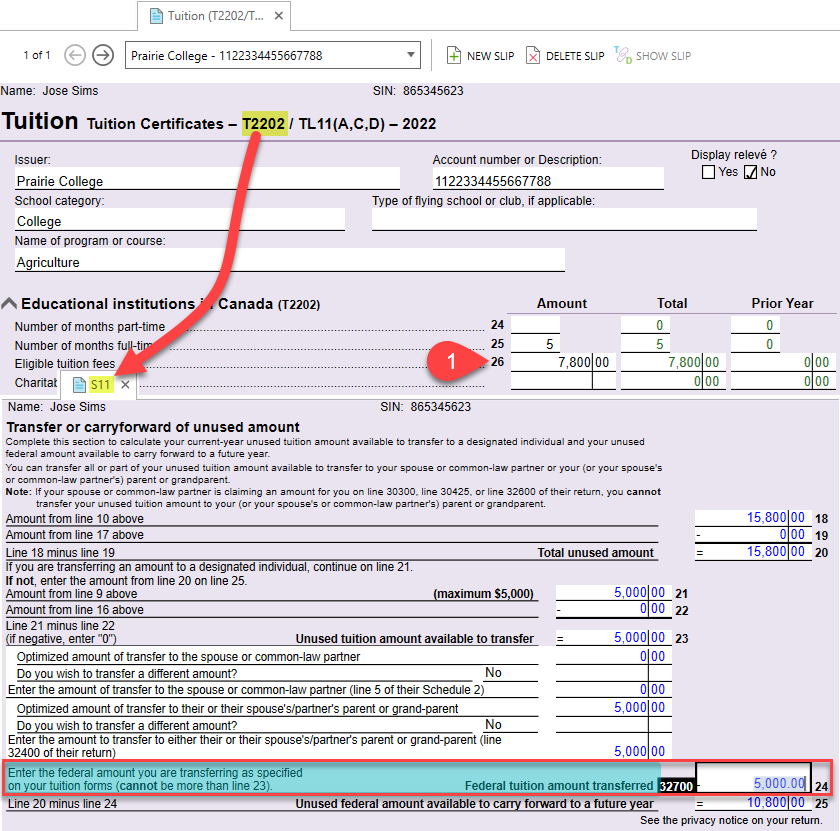

Tuition Amounts Transferred From a Dependant - TaxCycle

Who Can I Claim As a Tax Dependent?

Claiming a Domestic Partner as a Dependent - TurboTax Tax Tips

You can claim your girlfriend or your boyfriend on your taxes

Free Tax Filing with TurboTax® Free Edition

FAQs (Frequently Asked Questions)

What Are Dependents? - TurboTax Tax Tips & Videos

Miami-Dade offering free tax help for certain residents

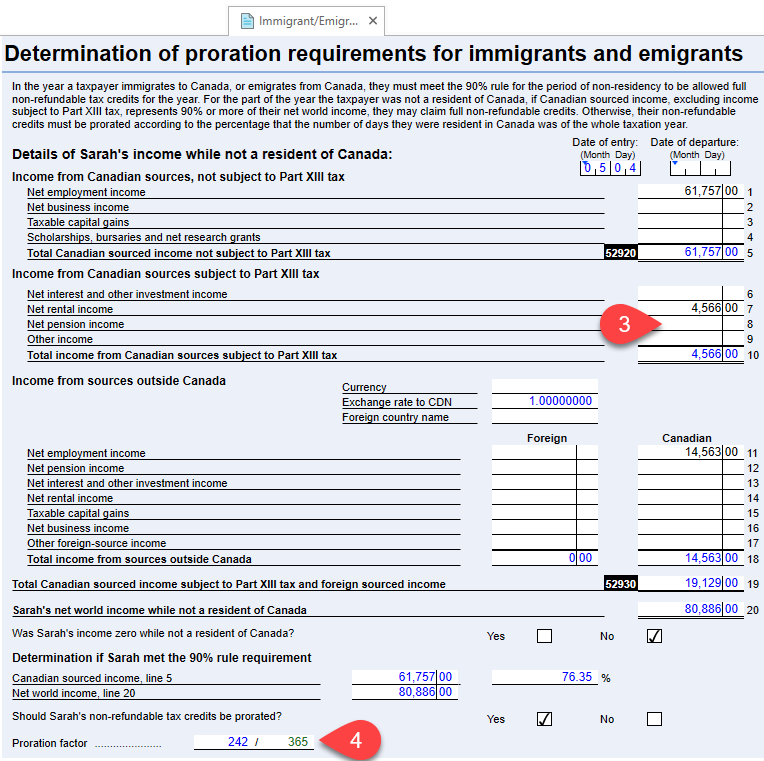

Immigrants, Emigrants and Non-Residents - TaxCycle

Tax Tips For Low-Income Earners In 2024 - Loans Canada

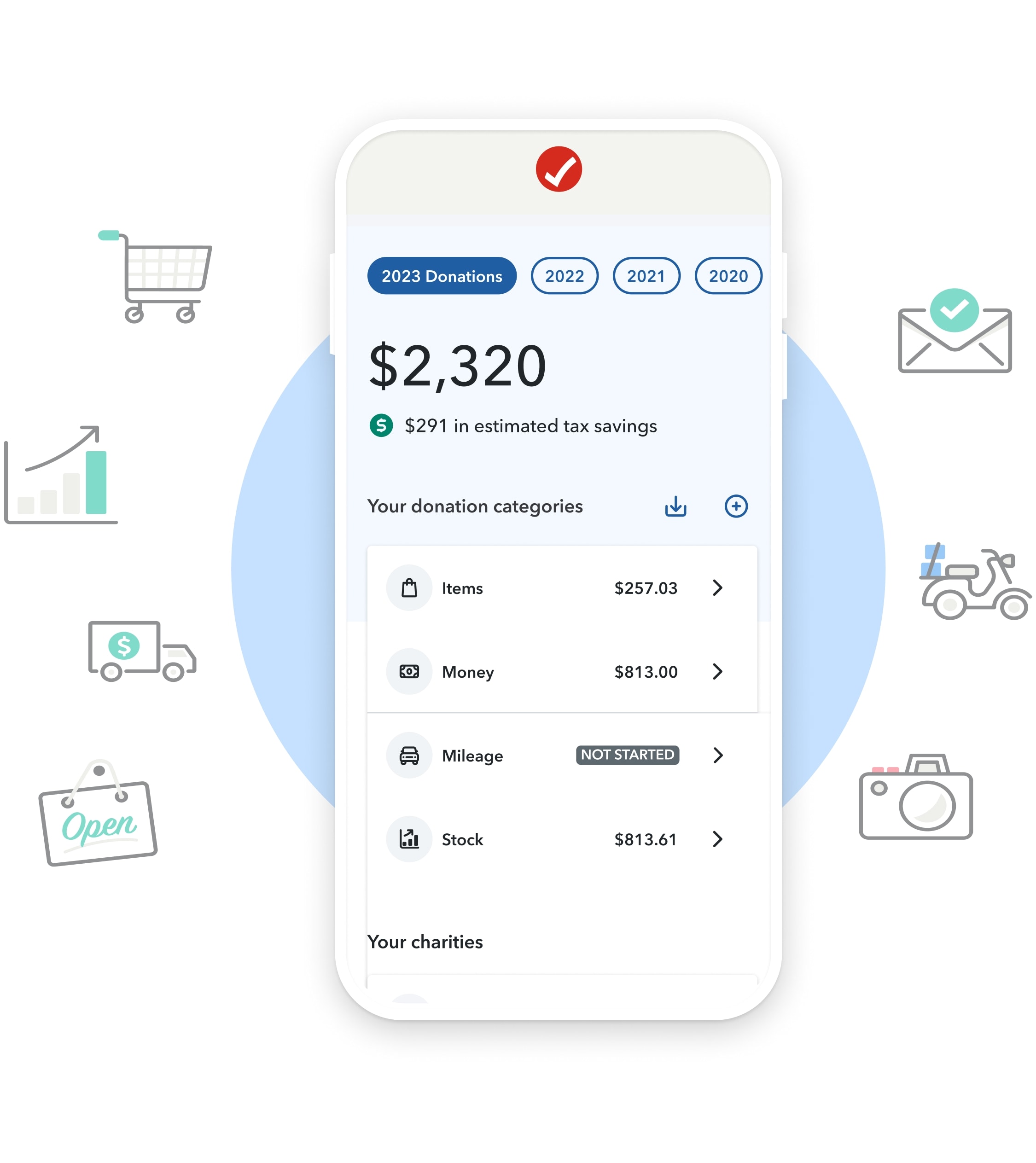

TurboTax® ItsDeductible - Track Charitable Donations for Tax

The Complete Guide to Auto-Fill my Return (AFR)

5 Tax Tips for Single Parents - TurboTax Tax Tips & Videos

Can I Claim a Boyfriend/Girlfriend as a Dependent on Income Taxes