HSA Eligible Expenses

DataPath helps TPAs get where they want to grow through innovative solutions for CDH accounts, COBRA, billing, and well-being benefits.

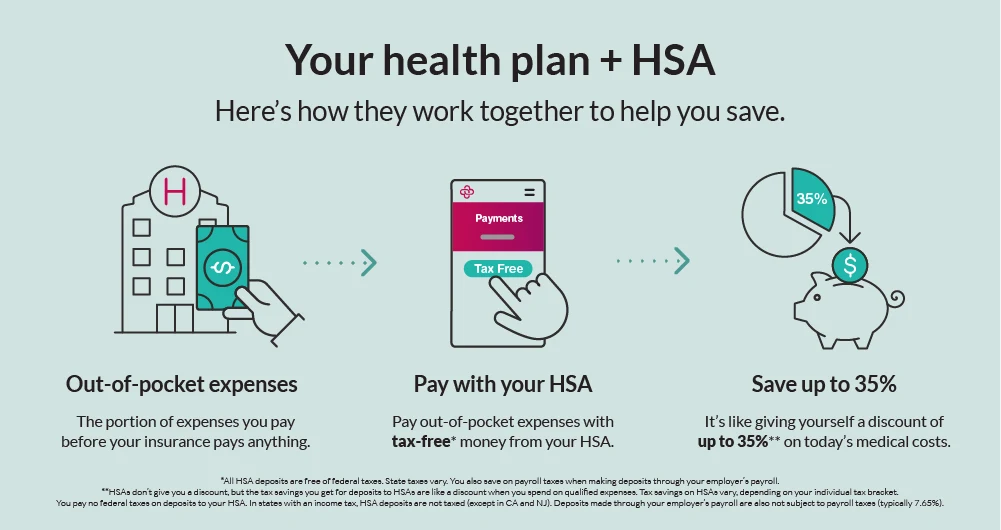

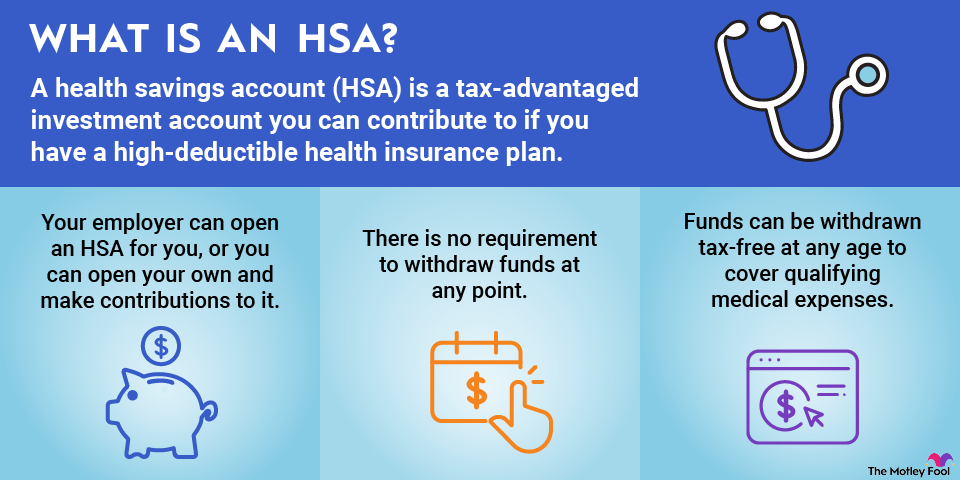

Since they were enacted in 2003, Health Savings Accounts (HSAs) have become an integral part of the consumer directed healthcare landscape for those with a high deductible health plan. One of the chief benefits of having an HSA is that account holders can use that money to pay for a wide range of eligible medical expenses for themselves, their spouses, and their tax dependents.

HSA Limits and Eligible Expenses

What Qualifies As An HSA Eligible Expense?

What Qualifies As An HSA Eligible Expense?

Important HSA Updates: 2020 HSA Contribution Deadline Extended and HSA-Eligible Expenses Expanded

Using HSA funds for dependents' medical expenses

Explained: FSA and HSA For Concierge Medicine

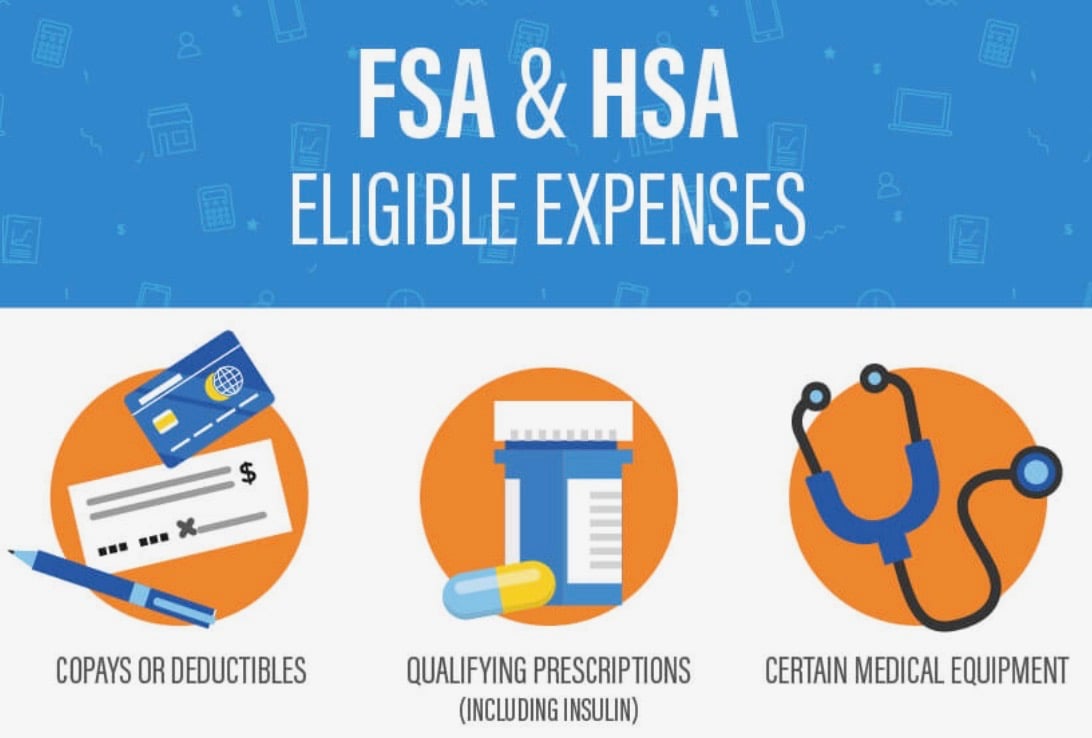

What expenses are HSA eligible?

Do You Meet the HSA Eligibility Requirements?

Unlock Your Health Savings with the FSA Store: Your Ultimate Guide

21 HSA and FSA-eligible items to shop in 2023, per experts

A Beginner's Guide to HSAs, USSFCU

Health Savings Accounts (HSAs) Explained

List: Eligible Medical Expenses (Humana)