ITR for Income upto 5 Lakh: Why you should file ITR even if your income is less than Rs 5 lakh - The Economic Times

If you have an net taxable income below Rs 5 lakh, then you are eligible for income tax rebate u/s 87A which will essentially make your tax liability nil. Nonetheless you should file ITR because every person whose income is above the basic exemption limit is mandated to do so.

)

Legal heir bound by law to file deceased's tax return for year of death

What is Income Tax Return: Meaning and Process of Filing ITR

mistakes while filing ITR: ITR filing mistakes often made by taxpayers - The Economic Times

itr filing last date: Has the ITR filing deadline been extended beyond July 31? - The Economic Times

The unintentional tax-saving investment that most salaried employees do - The Economic Times

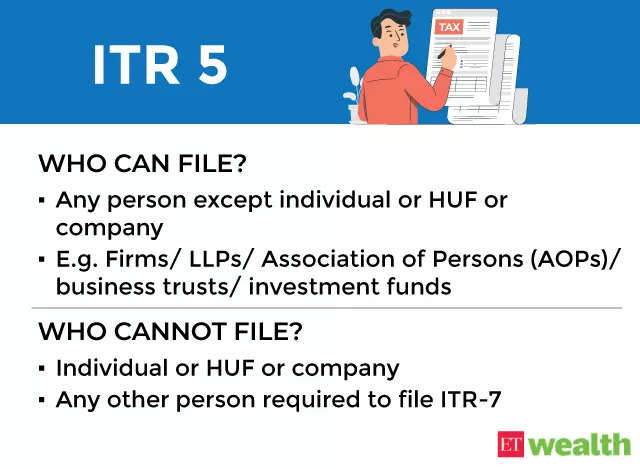

ITR filing for FY 2022-23: Which income tax return form applies to

Income Tax notice: 5 reasons you could get an income tax notice and how to deal with it - The Economic Times

How to File ITR for Income under 2.5 Lakh

Why filing ITR is important even if your salary is not taxable

Income tax return filing: Do you have to file an ITR when you do

The Economic Times on LinkedIn: Who can and cannot file income tax

ITR filing: How to report income from investments

ITR AY 22-23: Income Below Exemption Limit? Filing Income Tax Return is Must in these Cases - News18

Income Tax Return Filing: Advantages of filing ITR even if total

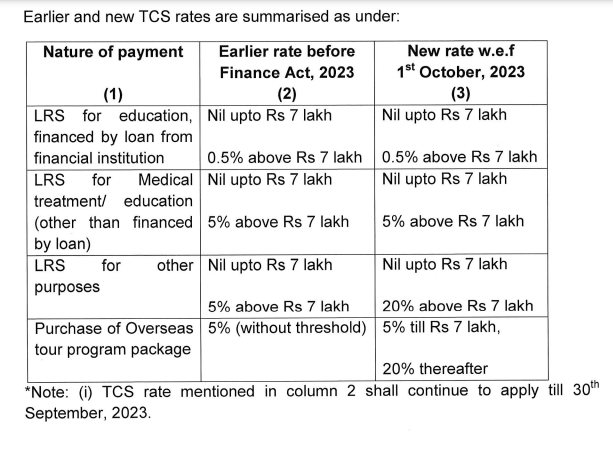

Tax on Foreign Remittance in India: Sending & Receiving Money