Low-Income Housing Tax Credits

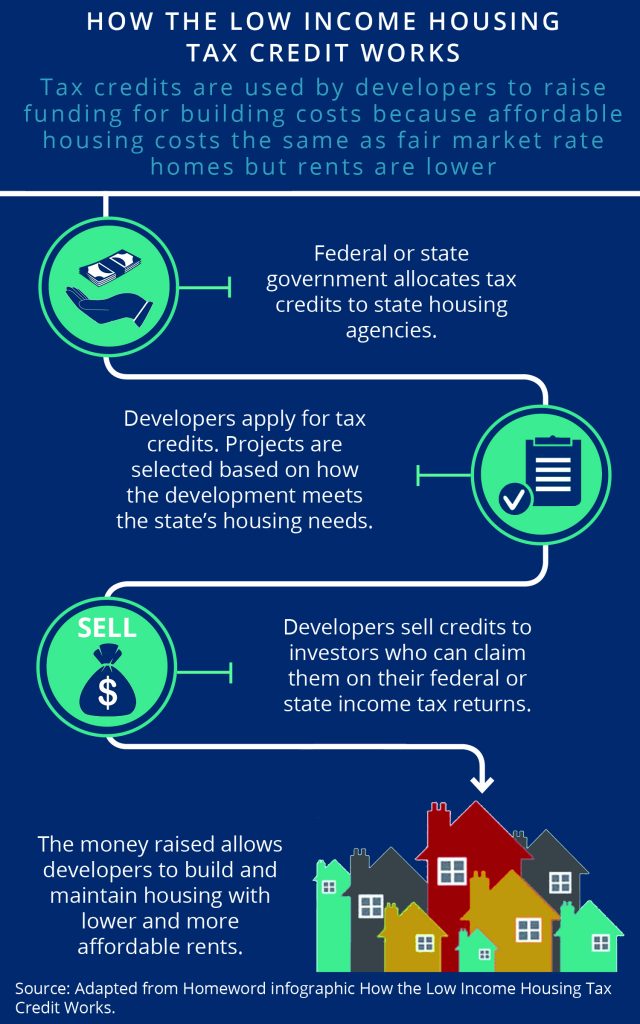

The Low Income Housing Tax Credit (LIHTC) program was created in 1986 and is the largest source of new affordable housing in the United States. There are about 2,000,000 tax credit units today and this number continues to grow by an estimated 100,000 annually. The program is administered by the Internal Revenue Service (IRS). The […]

State and Local Strategies to Improve Housing Affordability

Proportional Amortization for Tax Credit Investing

Low-Income Housing Tax Credit Program

HWA #HWAA #HUD #Housing #Urban #Development #Low-income #Housing

Debunking another myth surrounding low-income housing tax credits

Federal housing tax credits don't always serve those who need them

LIHTC Developments From Concept to Reality [Tipping Point 2020]

Low-income housing tax credits financial definition of low-income

The Low-Income Housing Tax Credit Program: The Fixed Subsidy and

Maximizing Wisconsin's Low-Income Housing Tax Credits

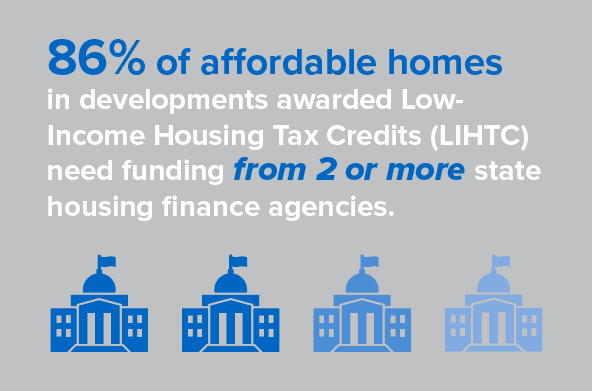

Creating a Unified Process to Award All State Affordable Rental

Low Income Housing Tax Credit: Invest in Communities and Reduce

Free Report: What Is the Low-Income Housing Tax Credit in Arizona