Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

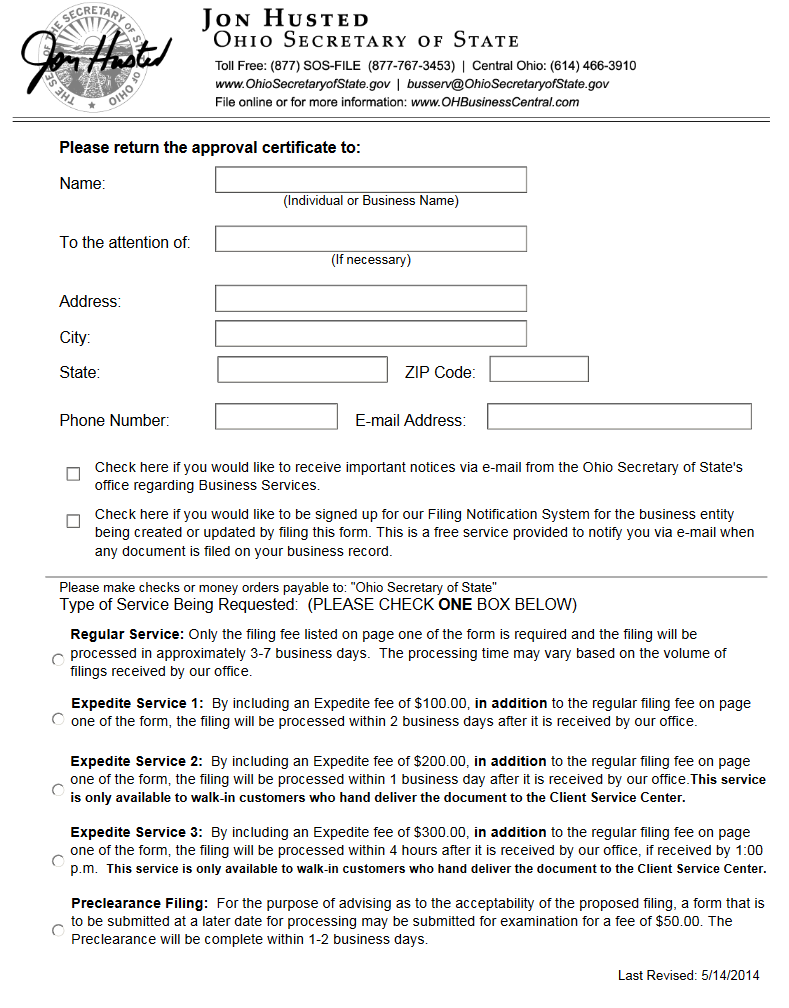

Free Ohio Foreign Nonprofit Corporation Application for License

Understanding the Benefits of a Series LLC - Carlile Patchen & Murphy

Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

Baldwin's Ohio Revised Code Annotated comprises a comprehensive research tool for anyone desiring instant access to Ohio statutes, constitution, and

Baldwin's Ohio Revised Code Annotated (Annotated Statute & Code Series)

Nonprofit Board of Directors, Officers & Members Explained

Most Common Lawsuits for Nonprofits - Emplicity PEO & HR Outsourcing

Tax Time New -United Way of Central Ohio

How to Start a Nonprofit in Ohio

What Can I Do If a Nonprofit Isn't Following Its Bylaws?

What You Should Know About Sales and Use Tax Exemption Certificates, Marcum LLP