Section 44C of the Income Tax Act ,1961

Section 44C of Income Tax Act, 1961 -Tax Deduction at Source in respect of Head Office expenses of Non Residents.

Expenses Incurred Solely for Indian business do not fall u/s 44C

section 115ad tax on income of foreign institutional investors

List of relatives covered under Section 56(2) of Income Tax Act

FAQs on Futures and Options

Section - 44C, Deduction of head office expenditure in the case of non

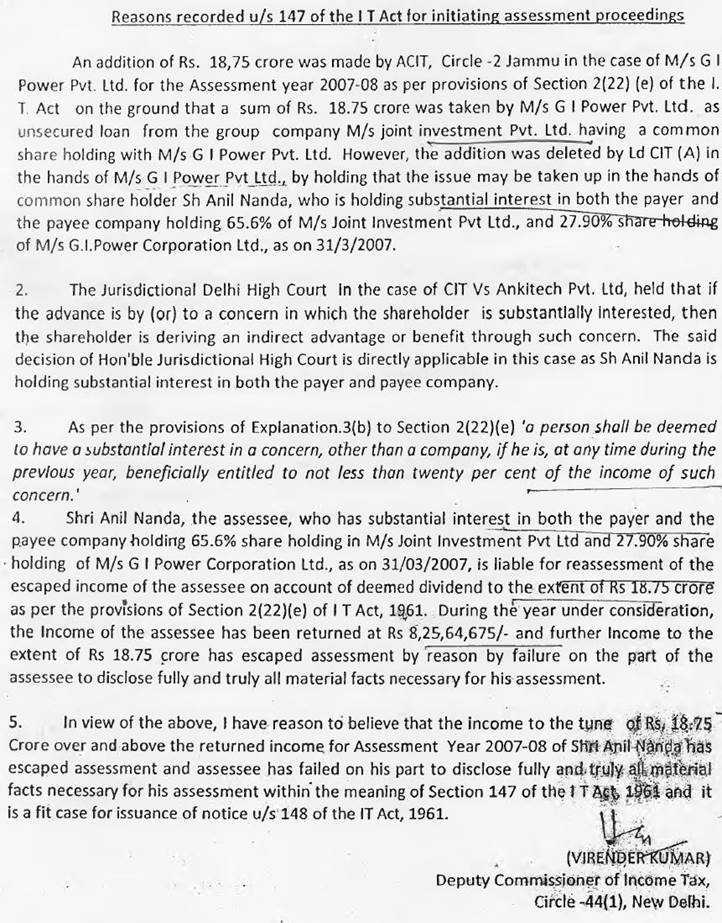

International Taxation Case Studies Compiler, PDF, Loans

Income tax act 1961

Voluntary Tax Audit u/s 44AB of Income Tax Act, 1961. Is it

Section 44AA of the Income Tax Act, 1961: A Comprehensive Guide

Proposal for Amendment of Rule The Central Board of Direct Taxes

International Taxation Case Studies Compiler, PDF, Loans

Tax Audit Report U S 44ab Of Income Tax Act 1961

Income Tax Act, 1961 Section 13(1)(D)(I)

Section 44C of Income Tax Act 1961