What is 80D for senior citizens

How Senior Citizens Can Save Taxes with Medical Bill Under Section 80D?

How Senior Citizens Can Save Tax with Medical Bills u/s 80D?

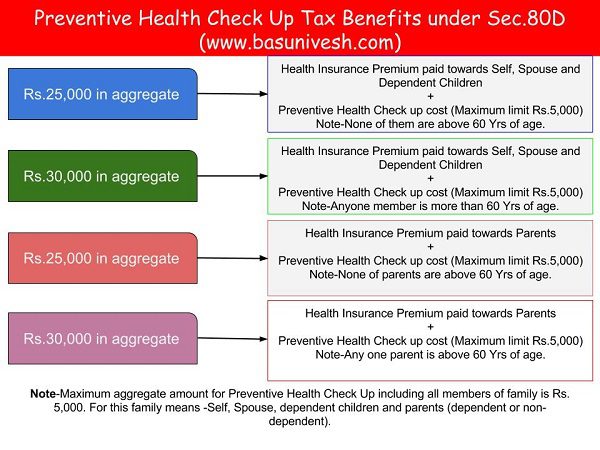

SR Associates - Section 80D -------------------- Deduction u/s 80D on health insurance premium is Rs 25,000. For Senior Citizens it is Rs 30,000. For very senior citizen above the age of 80

DEDUCTION U/S 80D HEALTH INSURANCE PREVENTIVE HEALTH CHECK UP MEDICAL EXP.

Stories

My father is senior citizen and mother is not, what is the maximum amount I can claim for their insurance under parental insurance tax exemption? - Quora

Senior Citizen Medical Bills Remain Tax Exempted I Bajaj Allianz

Section 80D Deduction EXPLAINED, SAVE TAX on Health Insurance Premiums

Preventive Health Check Up - Tax Benefits under Sec.80D

Section 80D: Deductions for Medical & Health Insurance

80d medical insurance premium receipt pdf: Fill out & sign online

.jpg)

Tax Benefits for Senior Citizens Budget 2018 proposes tax, other benefits for senior citizens: Rs 50,000 interest income exempted