What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

:max_bytes(150000):strip_icc()/DDM_INV_accounting-records_final-4x3-31994fdd4ca34b9eba06ab533cb92b5f.jpg)

Accounting Records: Definition, What They Include, and Types

Work with Journal Entries with Foreign Currency

Accounting for Investments in Debt and Equity Securities

News - Prager Metis

Tax, Accounting and Startups — Difference between Foreign Currency

Becker FAR - Intercompany Transaction Retained Earnings Example

JTAER, Free Full-Text

What types of journal entries are tested on the CPA exam

Marty Zigman on Learn How To Craft Better NetSuite Financial

Blog, Magistral

Advanced Accounting Foreign Currency Transactions

Accounting for Foreign Exchange Transactions - Withum

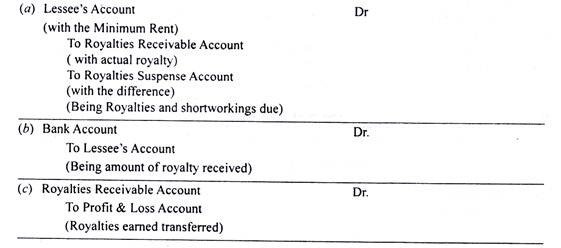

Accounting records for Royalty in the Books of Landlord – intactone