Andorra Tax Rates: a Complete Overview of the Andorra Taxation for

Andorra offers favourable taxation regimes for individuals and companies. The income tax applies only to the annual amount exceeding €24,000. The corporate tax rate is 10%, and the VAT is 4.5%. Learn more about the effective rates, exemptions and how to become a tax resident of Andorra.

Residency in the Principality of Andorra

Taxation in Andorra: one of the most favourable in Europe

European Union Andorra Income Tax Flat, PDF, Tax Haven

Corporate tax rate Andorra – What is the income tax rate ?

/_next/image/?url=https%3A%2F%2

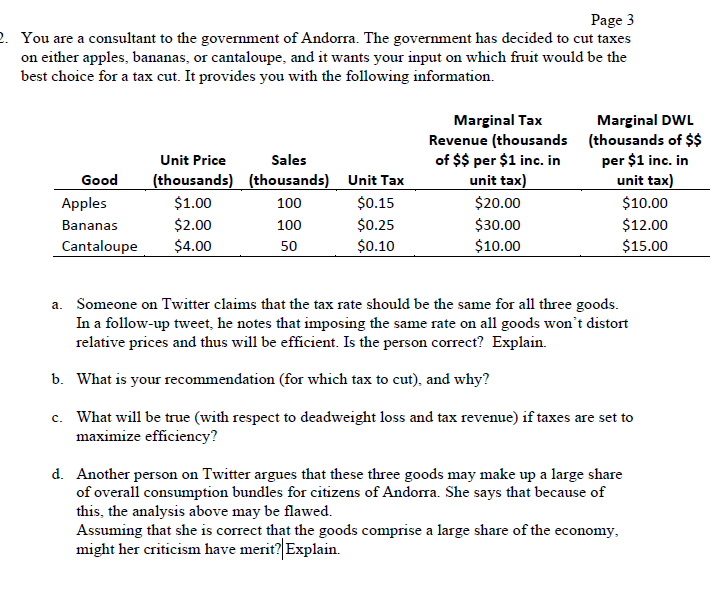

Solved Page 3 2. You are a consultant to the government of

Andorra, History, Facts, & Points of Interest

Andorra Tax Calendar for Expats

What is Andorra's r controversy? - N26

OECD Tax Database - OECD

Tax rates in Europe - Wikipedia

Taxes in Andorra [2023] – A Tax Haven in Europe [Clear Finances]

Impuestos trading en Andorra: ventajas e inconvenientes

Andorra, History, Facts, & Points of Interest