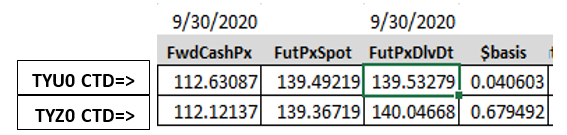

How to calculate carry and roll-down (for a bond future's asset swap) –

Bobl spread is 53.1bp, we are 3 months away from mar18 delivery, and a client blasts “what do you see as carry and roll for OE asw?”. Here are my notes on the mechanics of the calculati…

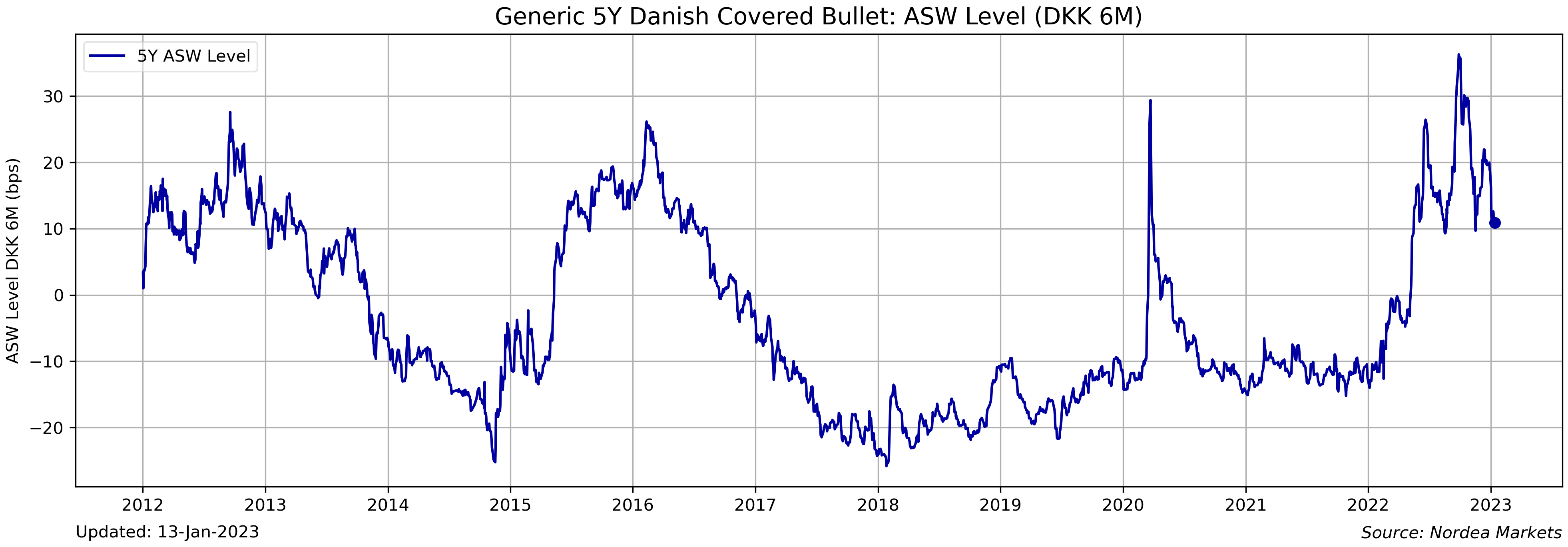

Bonds & bold: When is roll a good predictor of future returns?

Lab Carry

Returns Attribution Analysis

:max_bytes(150000):strip_icc()/forwardrate.asp-final-abecab1927554cd58edbbe2e392e4b80.png)

Forward Rate: Definition, Uses, and Calculations

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

Lab Carry

On The Finer Details of Carry and Roll-Down Strategies - Moorgate Benchmarks

Credit Derivatives core concepts and glossary

Net Operating Loss (NOL)

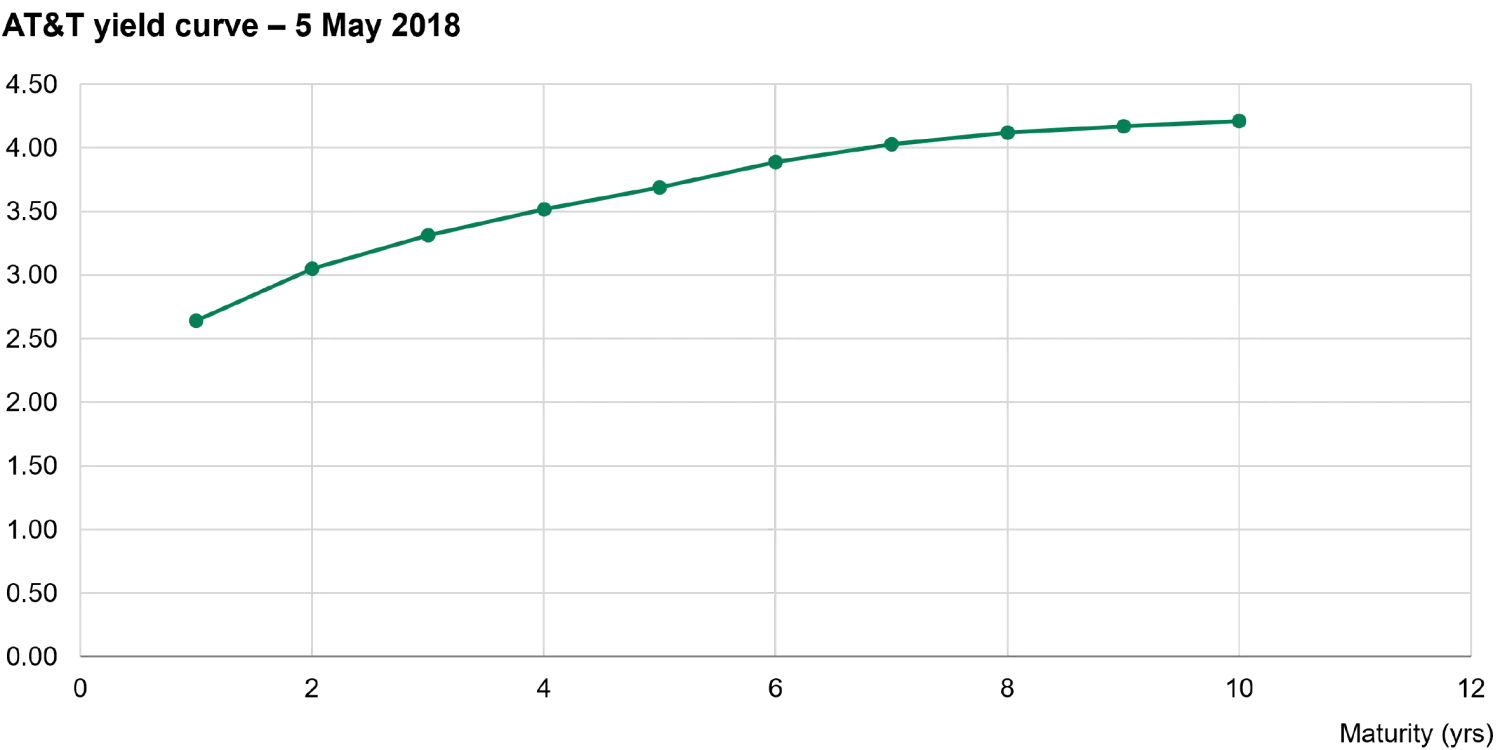

Carry and Roll-Down on a Yield Curve using R code

Forward Rate Formula Definition and Calculation (with Examples)

Carry and Roll-Down on a Yield Curve using R code

Understanding Treasury Futures Roll Spreads, Futures Brokers

Fixed Income 101: Roll-down

Fixed income: Carry roll down (FRM T4-31)