Collateral damage: Foreclosures and new mortgage lending in the

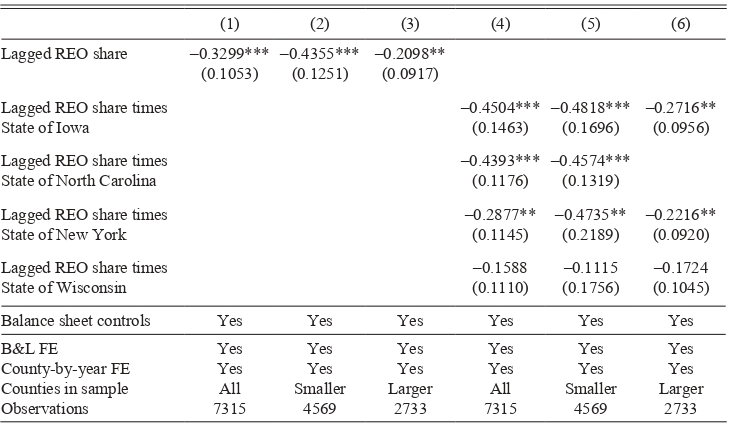

Although severe crises in housing markets contributed to both the Great Recession of 2007 and the Great Depression of the 1930s, the role that housing-related financial frictions played in the crises has yet to be explored. This column investigates the impact that foreclosures had on the supply of new home mortgage loans during the housing crisis of the 1930s. It shows that an increase in foreclosed real estate on a building and loan associations’ balance sheets had a powerful and negative effect on new mortgage lending during the 1930s.

The Great Foreclosure Fraud - The American Prospect

Loan and property guarantee - yes or no? — Dostupný advokát

Lingering impact: Report on 2016 foreclosure trends

Collateral loans: A complete guide

Foreclosure: What it Means in Real Estate

Bruised but not broken: The state of today's jumbo mortgage market

:max_bytes(150000):strip_icc()/dotdash-nonrecourse-loan-vs-recourse-loan-Final-2118fe68f30c4cfaaaeaacbded201963.jpg)

Recourse vs. Non-Recourse Loan: What's the Difference?

Collateral Damage: The Impact of Foreclosures on New Home Mortgage

Collateral damage. The Spillover Costs of Foreclosures By Debbie

Why the Fed Can Let the Housing Bust Rip: Mortgages, HELOCs

Aversion to Risk Deepens Credit Woes - The New York Times

Even in Napa, foreclosure crisis hits home