Why Lululemon's 2019 Profits Should Have Grown Nearly 30% Despite A Sharp Increase In Expenses

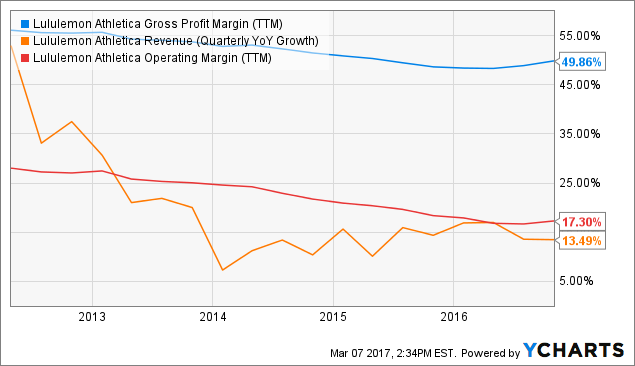

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

Lululemon Athletica Inc. (NASDAQ: LULU) has achieved robust growth over 2015-18, with the company’s revenue increasing a whopping 59%. But the apparel company’s expenses following a similar trend over this period – resulting in profits remaining broadly level.

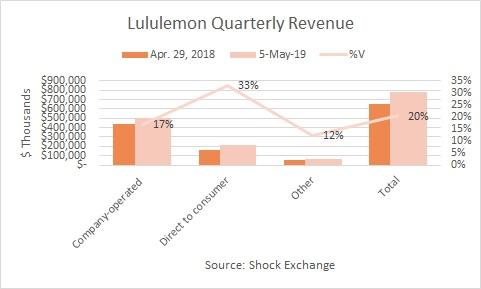

Lululemon Sales Revenue Online International Society of Precision Agriculture

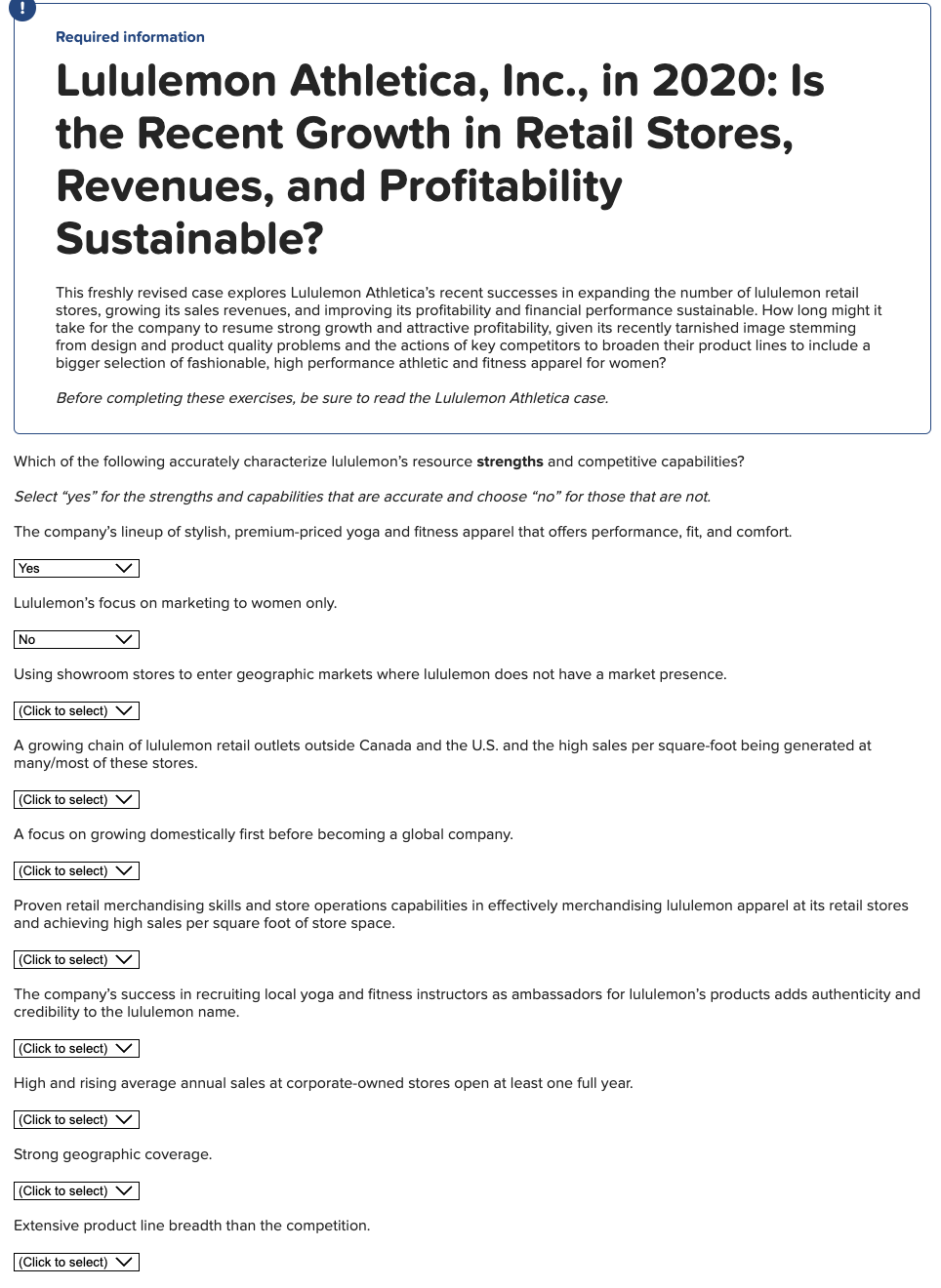

Solved Required information Lululemon Athletica, Inc., in

Lululemon increases guidance as sales, profit each up 18 per cent - Business in Vancouver

Lululemon Valuation

Solved Required information Lululemon Athletica, Inc., in

Lululemon Revenue 2019 International Society of Precision Agriculture

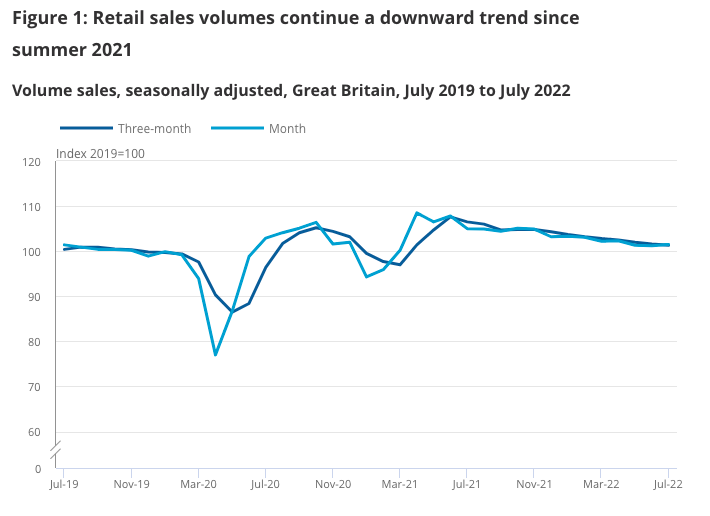

Article Archives • Detego

How Much Does Lululemon Make In Profit Margin International Society of Precision Agriculture

Realty Income Shares Have Plummeted: Buy, Hold, Or Sell? (NYSE:O)

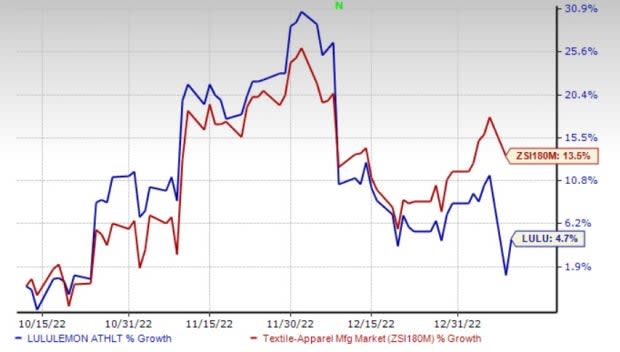

lululemon (LULU) Raises Revenue Forecast, Faces Margin Concerns

Growth Study] Lululemon Athletica – How to Beat Nike by Creating a New Category – Dejan Gajsek

Is Lululemon's growth sustainable?