Should We Eliminate the Social Security Tax Cap? Here Are the Pros

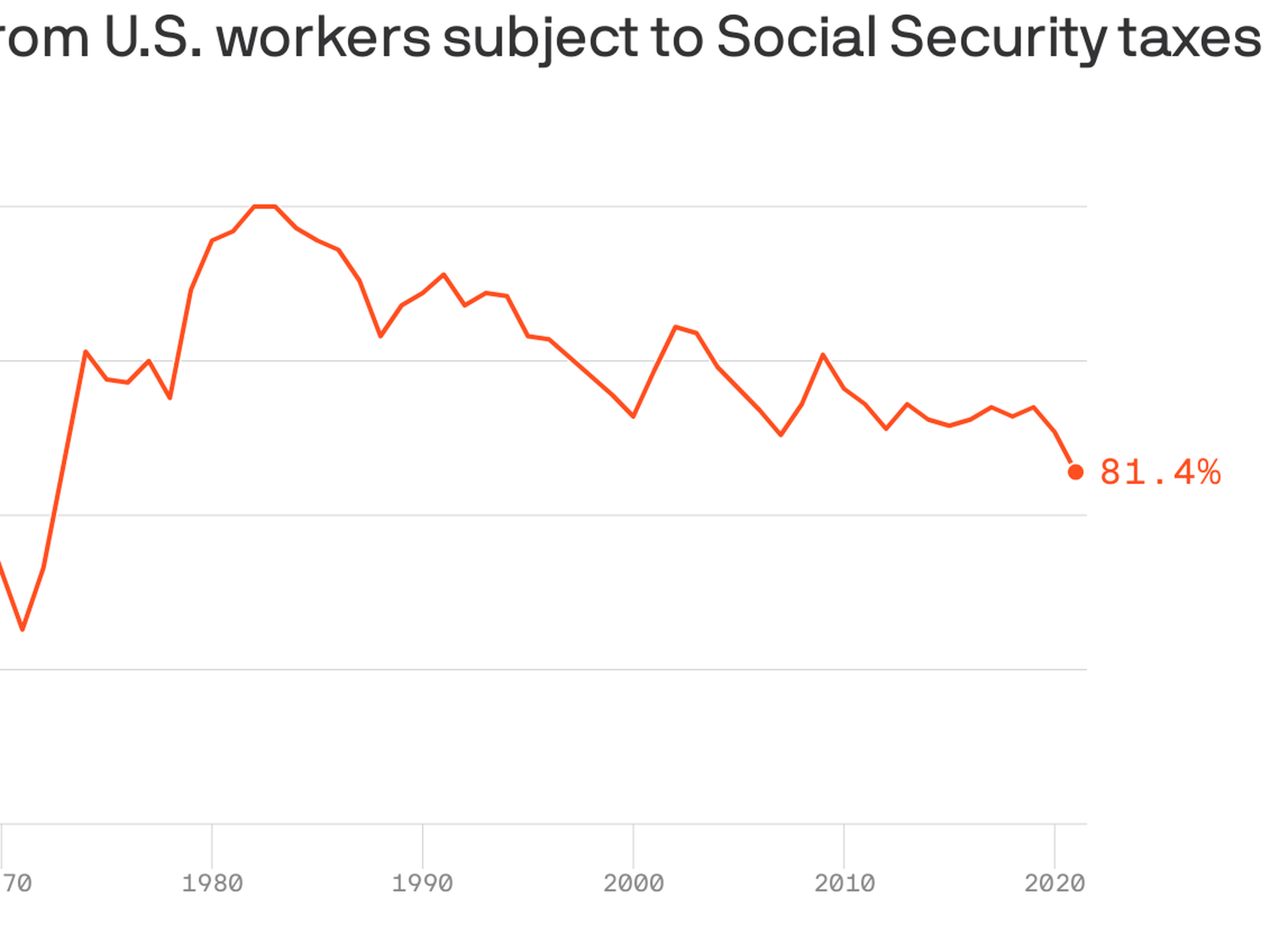

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

AARP - You can request federal tax withholding from your Social Security at rates of 7%, 10%, 15% or 25% by completing the IRS form W-4V and sending it to your local

Income Definitions for Marketplace and Medicaid Coverage - Beyond the Basics

Understanding FICA Taxes and Wage Base Limit, fica tax

The Peter G. Peterson Foundation on LinkedIn: Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

The Peter G. Peterson Foundation on LinkedIn: #socialsecurity #fiscalpolicy

Increasing Payroll Taxes Would Strengthen Social Security

upload.wikimedia.org/wikipedia/commons/9/91/2023_U

Social Security Programs Essay

What is the FICA Tax and How Does it Connect to Social Security?, fica tax

Should Social Security Be Privatized? Top 6 Pros and Cons